*Advertorial Content

When you become a parent your responsibilities increase massively, as you make the transition between looking after just yourself to looking after little ones too. Looking into the future is so exciting when you have children; witnessing the milestones they'll reach, skills they'll develop and independence they'll gain. When it comes to thinking of the future with Isabella, Poppy and soon to be a third baby it can seem daunting as there are so many milestones and events to come. Many of these can cost a lot of money, such as going to university, first car, buying a house, getting married etc., so being prepared is something worth considering. It may seem like these exciting events are a long way off and in reality they are, but saving money and putting strategic plans in place takes time so it's never too early to start.

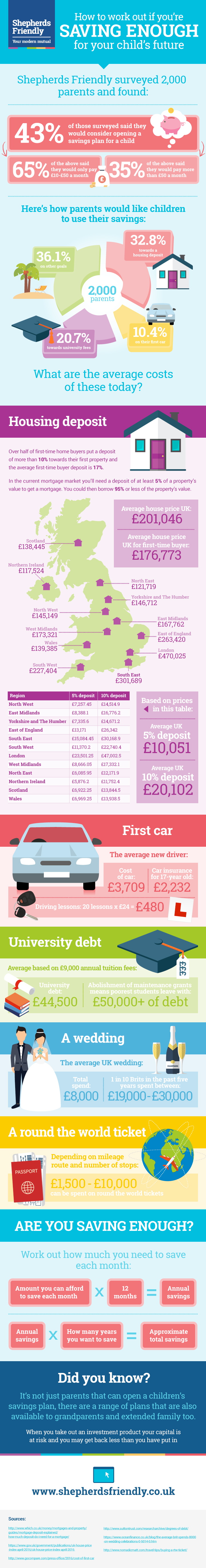

Money.co.uk did some research in 2016 and estimated that parents need £259,000 to cover those expenses, which I'm sure you'll agree is pretty daunting; especially when you times that by three, as we'll soon have three children. I think it's fair to say that a lot of us don't have that kind of money sitting in our banks just waiting for our children to reach the next milestone/event. Instead it is important to focus on smaller targets or specific goals, which are much more manageable.

However Money.co.uk found that 28% of parents said that saving simply wasn't an option, instead a luxury that they couldn't afford. Luckily, Shepherds Friendly and many other providers have various saving options that can help parents save money for their children, such as a Junior ISA where family and friends can contribute on behalf of the child with any capital growth being tax free. Shepherds Family have also put together the following infographic to help you consider whether you are saving enough to reach saving goals for the future of your child/ren:

It makes me so excited seeing all of these milestones and to think that the girls have all of this to look forward to. I really hope that as parents we can financially support them through each and every one of these.

It makes me so excited seeing all of these milestones and to think that the girls have all of this to look forward to. I really hope that as parents we can financially support them through each and every one of these.

Feel free to leave a comment - I love reading every single one :)

Helen x

My kids do have savings accounts, I used to have a direct debit going in just dropping £20 per month, but it gets hard to have the spare cash to do it. But I do agree that I would love to put more aside for all of them.

ReplyDeleteWe save for both our girls and aim to do a bigger deposit when we can too to keep it topped up. As for uni fees, I'll cross that bridge when we come to it!!

ReplyDeleteWe do save what we can but it's hard when there are so many expenses day to day. It does make me a little anxious thinking about just how much things are going to cost - especially uni and deposits for houses!

ReplyDeleteWe do save what we can but it's hard when there are so many expenses day to day. It does make me a little anxious thinking about just how much things are going to cost - especially uni and deposits for houses!

ReplyDeleteA few months ago I set up a direct debit into a specific saving's account. It's only £5 a month but over time that will add up and hopefully make all the difference. You have to start somewhere!

ReplyDeleteWe pay into Junior ISAs for out too - no huge gestures but will hopefully help them in further education. We are lucky in that their grandparents gave put considerable sums into trust funds for them, lucky things

ReplyDelete